|

"

See St.

Louis Business Journal Article!

The "Historic Tax Credit Program" is the most

Click here to learn more about Historic Tax Credits. Click here to read details

about the benefits

This is a link to Lookup

and Contact

|

Price: $15.00

| Missouri Historic Preservation Alliance, Missouri Downtoan

Association, Missouri Association of Realtors, Metropolitan Congregations United, St. Louis RCGA, BOMA Missouri, Missouri Growth Association, St. Louis AIA, Landmarks, Mayors of the cities of St. Louis, Springfield, Kansas City, and St. Louis County Executive. |

|

"

Click here to view the text below in a printable format (Acrobat Reader required)

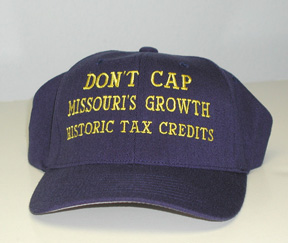

Why Capping the Historic Preservation

Tax Credit

Would be Catastrophic for the Stateís

Economy

- The Historic Tax Credit provides a direct cash infusion into state and local budgets.

Would you take $1.50 for a $1.00? Thatís exactly what the Missouri Historic Tax Credit does.

The cost of credits in FY2000 was $20 million (according to Department of Economic

Development figures). The direct increase in state and local taxes for that same year was

$30 million (according to a Department of Economic Development-sponsored study).

The credits generated, in direct dollars, 1 ½ times their cost. Capping the credit would

increase the deficit and create an even bigger budget crisis. DED says the state benefit is

$1.78 per $1.00 of credit.

- The total benefits of the credit far exceed the direct infusion of dollars, boosting

Missouriís economy by over $1 billion each year (according to a 2001 study conducted

by Rutgers University).

- In 2000, historic preservation projects created:

- o $249 million in income

o $332 million in gross state product

o $292 million in in-state wealth

o $70 million in taxes, $30 million of that in state and local taxes, and

o 8,060 jobs.

- Historic preservation also generates $660 million annually in heritage

tourism spending, creating:

- o $325 million in income

o $574 million in gross state product

o $506 million in in-state wealth

o $147 million in taxes, $79 million of that in state and local taxes, and

o 20,077 jobs.

- A cap on Historic Preservation Tax Credits will bring a halt to redevelopment.

Developers and homeowners will not buy a building, pay carrying costs, insurances,

taxes and architect fees without knowing if a credit is available.

The Federal government recognizes that its historic tax credit must be uncapped in

order to work, and has thus remained so.

- This credit is the only widespread economic development tool working in Missouri

Ėand working for small towns as well as big cities.

- The Historic Preservation Tax Credits help revive economically unproductive

downtowns in both rural and urban communitiesĖthus increasing the state tax base.

In fact, 85% of eligible buildings are located in depressed areas, both urban and rural.

- This tax credit aids development in older areas, saving state and municipal infrastructure costs

for outlying development, such as highways.

- Missouriís law has become a national model, and numerous states, such as Iowa, Tennessee,

Wisconsin and Maryland, have tried to duplicate out success.

![]() Click

"

here

to view the above text - "Why Capping the Historic Preservation Tax

Credit

Click

"

here

to view the above text - "Why Capping the Historic Preservation Tax

Credit

would be catastrophic for the State Economy" in a printable

format (Acrobat Reader

required) ![]() "

"

![]() Click

"

here

to read about "Why Removing Residential Projects from Historic Tax

Click

"

here

to read about "Why Removing Residential Projects from Historic Tax

Credit Eligibility is Bad for Missouri" (Acrobat

Reader required) ![]() "

"

![]() Click

"

here

to read about "Historic Tax Credits Talking Points" (Acrobat

Reader required)

Click

"

here

to read about "Historic Tax Credits Talking Points" (Acrobat

Reader required) ![]() "

"

Friedman

Group, Ltd. & Friedman Development, Ltd. 245 Union

Boulevard, St. Louis, MO 63108

Phone:

314.367.2800 Fax: 314.367.3671 Erics@FriedmanGroup.com

Click here to return to Friedman

Group Home Page